Is a Family Holding Company Right for Me?

From Your Multimillion-Dollar Exit, by Wayne Zell

What is a Family Holding Company?

Basically, a family holding company is an LLC or a limited partnership that’s established to hold assets for the benefit of family members.

Who runs a Family Holding Company?

The general partner in a family limited partnership (FLP) or a manager in an LLC runs the show; they make all investment decisions. They deploy capital into new investments, and they make decisions about how and when to make distributions, except where an independent third party needs to be involved to avoid inclusion of the holding company assets in your estate.

What is the purpose of a Family Holding Company?

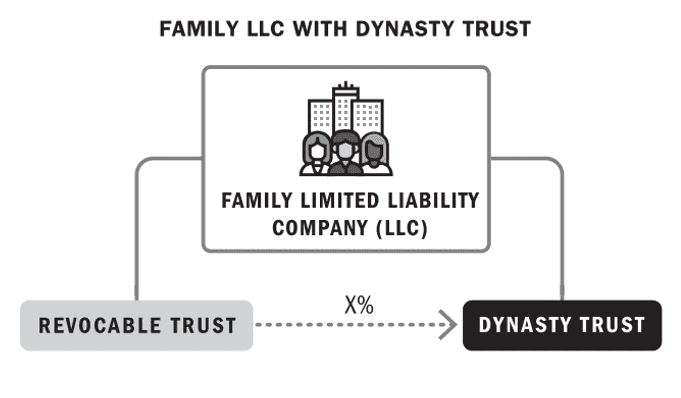

One goal of this structure is to ensure that assets can be shifted out of your estate and into the hands of future generations or trusts for their benefit. Instead of transferring an asset directly into the hands of the next generation, you can combine family-owned assets into the family holding company and use it as a centralized way of managing the family’s wealth. Then you can transfer shares or a percentage interest in the family holding company that owns the assets to the next generation or trusts for their benefit.

What are the advantages of a Family Holding Company?

The interest in the family holding company usually attracts significant valuation discounts because the entity is closely held, which leads to a lack of marketability discount for the interest being transferred. In addition, if the interest is nonvoting or does not otherwise participate in the management of the entity, the interest can attract an additional lack of control discount, which allows the founder to achieve discounts of up to 40% or more of the value of the interest being transferred.

As noted earlier, the valuation rules for closely held entities have come under attack by Congress, by the Treasury Department, and in the IRC. Although various laws have been enacted to make it more difficult to achieve valuation discounts and shift wealth to the next generation using a family holding company, these techniques still thrive.

Another significant benefit of owning the assets in a properly structured family holding company is that in many states, your creditors will not be able to force the holding company to liquidate its assets or make distributions to you if they have obtained a court judgment against you or other members of the holding company.

What is a disadvantage of a Family Holding Company?

This asset protection benefit comes in the form of a charging order remedy, which prevents the creditor from taking your interest in the LLC or partnership. The creditor can only impose a lien on your ownership interest, so that any profit distributions that would have been made to you are instead made to the creditor. The charging order can prevent you from taking backdoor distributions from the holding company in the form of loans or fees, but you may still be able to take salaries (subject to possible garnishment of wages by the creditor). You will want to set up the LLC in a state where charging order remedies are the most limited, such as Wyoming, Nevada, and Delaware.

Conclusion:

In sum, family holding companies will afford you potential transfer tax savings and asset protection and allow you to centralize ownership and management of assets and properties for the family’s benefit.

To read more purchase Your Multimillion-Dollar Exit here.